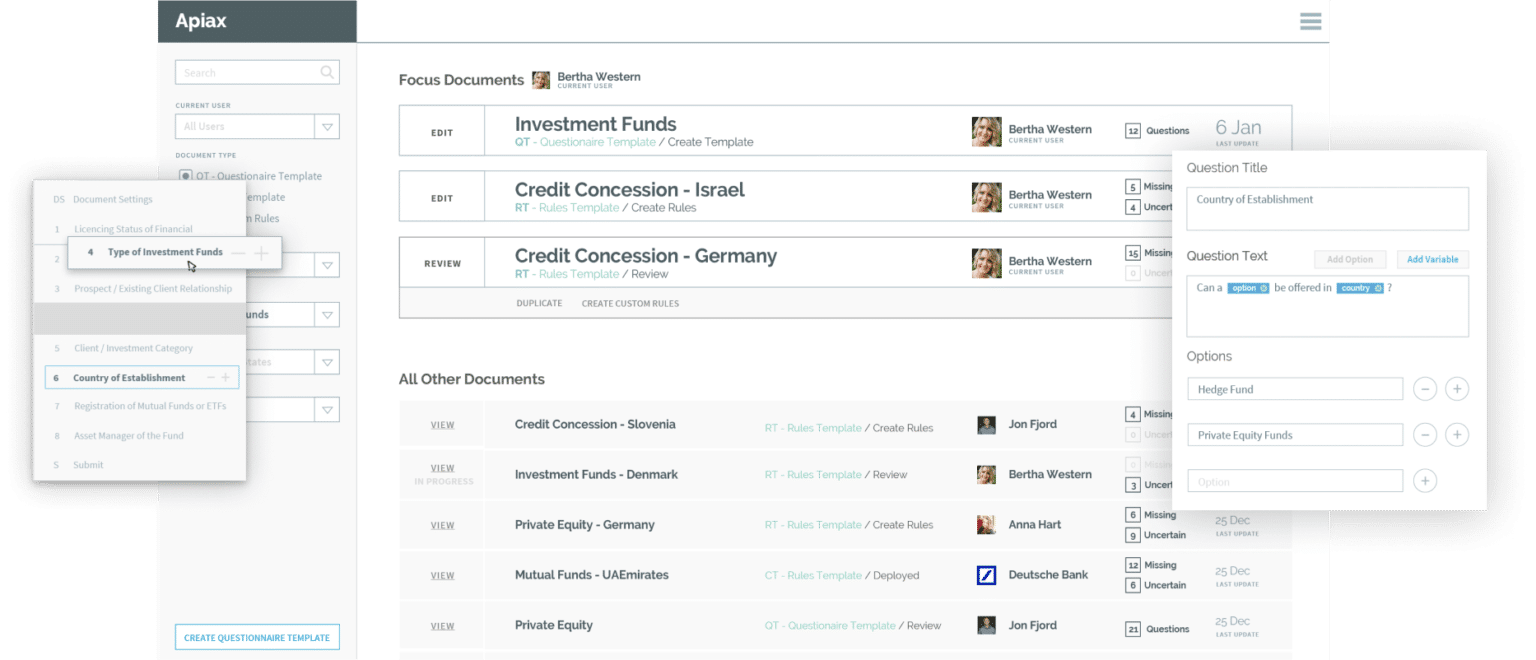

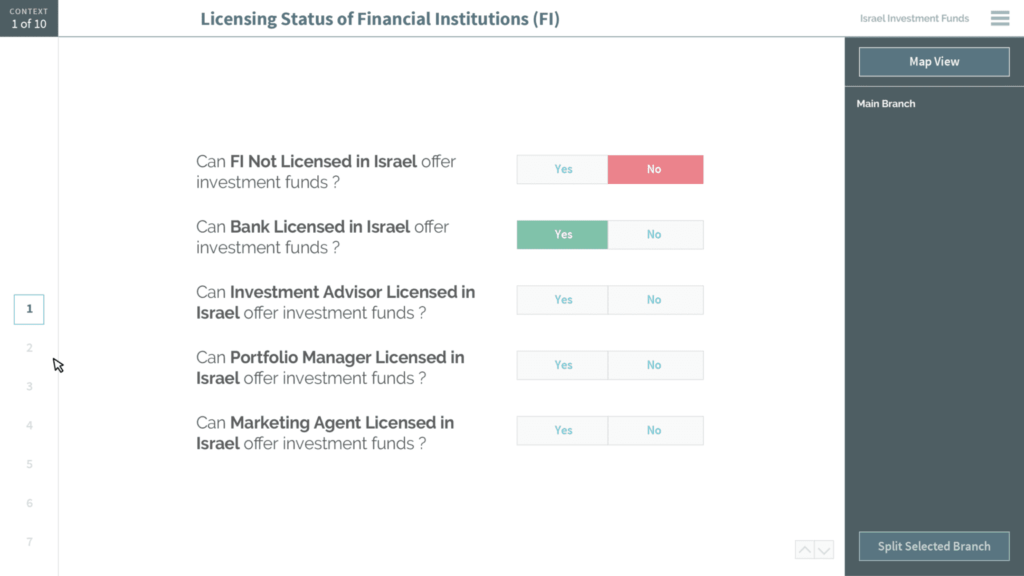

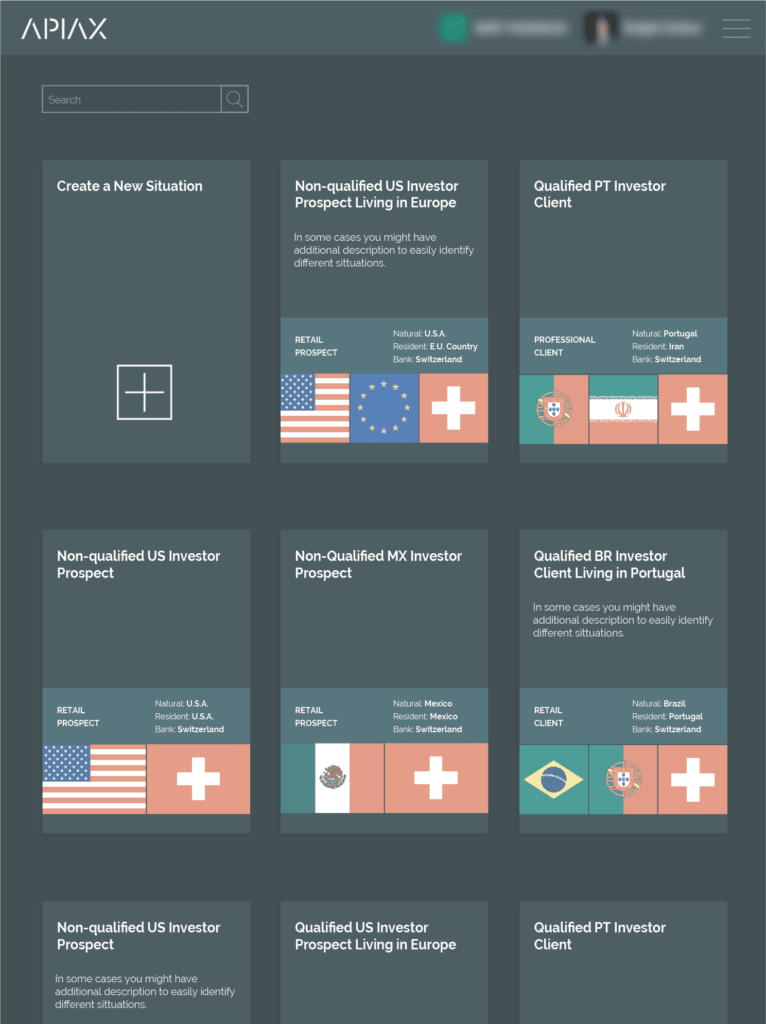

Apiax is a regtech company that builds a lean yet comprehensive solution to transform Banking’s complex regulatory landscape into digital and centralized rules and to manage the full lifecycle of digital regulations.

Fintech, Regtech

1 year

Switzerland

$8.1M

5

Financial institutions face mounting pressure from regulators.

The ever-growing list of industry regulations is met with inconsistent interpretation and implementation across jurisdictions. This wave of regulatory challenges leads to surging costs, increased business risks and a deceleration in innovation.

Apiax breaks down the regulation (financial, fiscal, data protection) into machine-readable compliance rules that can be implemented through an API into existing technology stacks, offering advice to front office roles inside banks.

An award-winning startup that’s gone on to raise millions

Since working with us, Apiax has gone on to win a range of startup awards, raised over eight million dollars and increased their team to over 75 people across five offices worldwide

Philip started his journey into tech over two decades ago as a software developer.

In 2004, he moved into financial services, driving financial transformation with some of the most prominent financial institutions in the world, like UBS Financial Services & Appway, part of FNZ – one of the world’s largest growth platforms.

This deep expertise and experience positioned him perfectly to found Apiax in 2017.

Since launch, Apiax has gone from strength to strength, raising millions of dollars and winning a number of startup awards in the process, such as The Early Stage Startup of the Year and The Digital Finance Innovation Award.

Let’s talk about

your project

Miami

Address: 10481 N KENDALL DR, STE D200A

MIAMI, FL 33176

Phone: 786-361-1989

Email: tim@evolvesoftinnovations.org