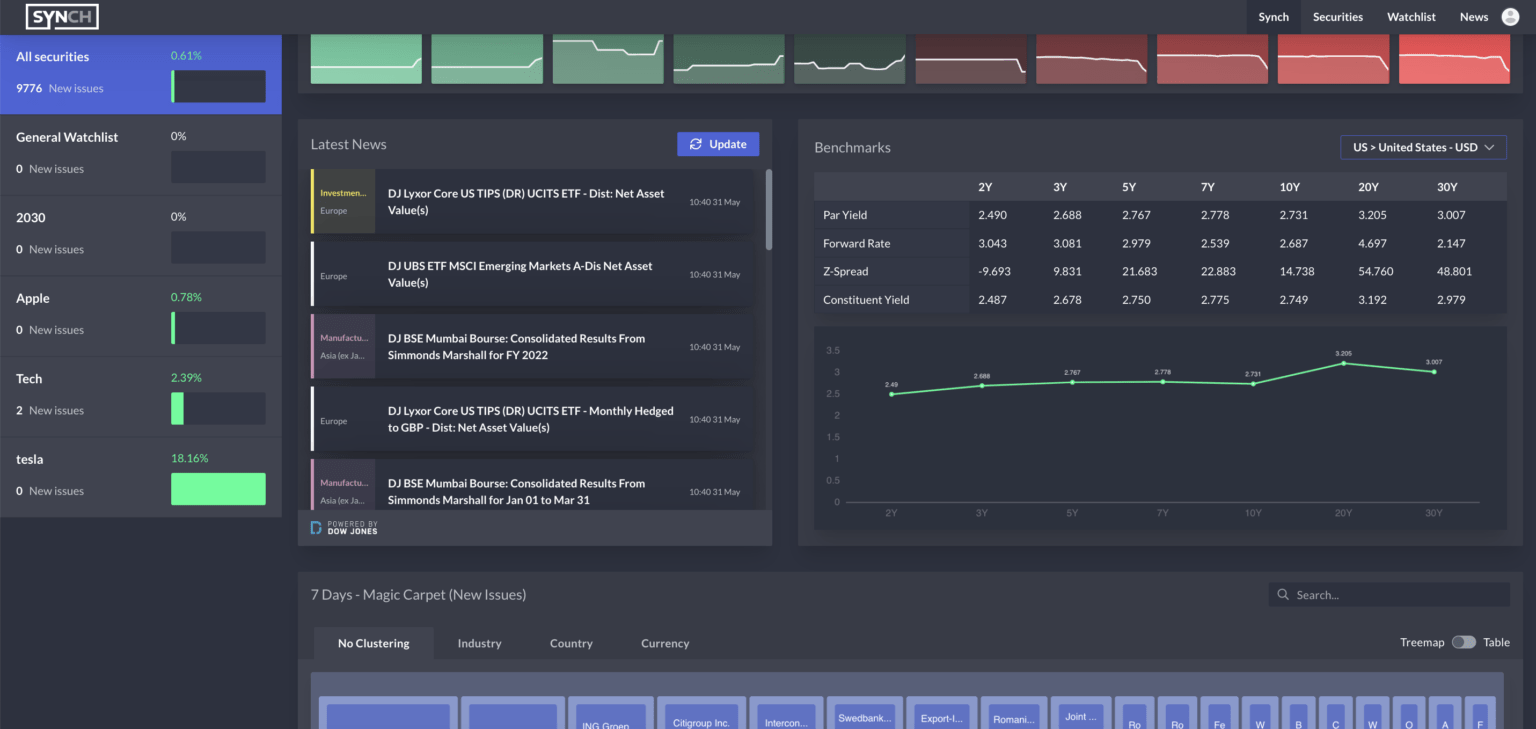

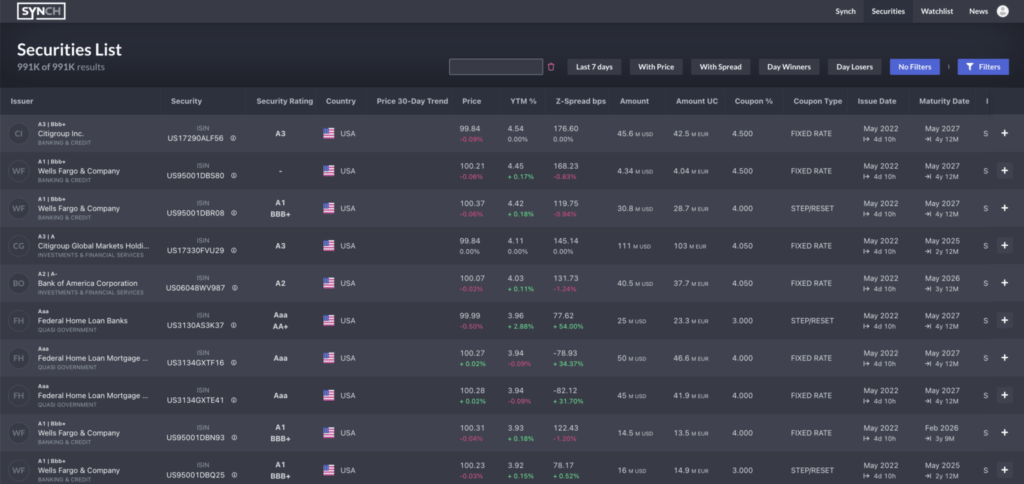

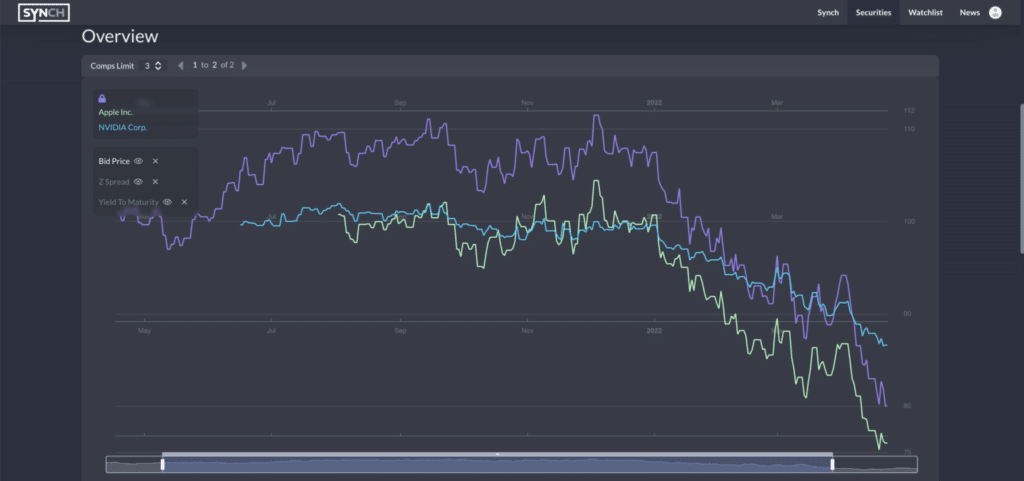

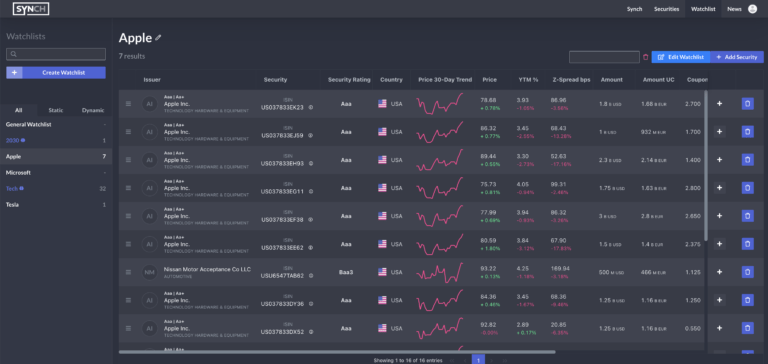

Synch is a single, curated ecosystem for bond professionals to source and analyse bonds with relevant, reliable and up-to-date data, in a cost-effective manner.

Besides Bond information and News, thanks to partnerships with ICE, FactSet and DowJones, Synch provides its users with comprehensive consistent data, specialised for fixed income trades in a timely and costly manner.